Agnico-Eagle Mines (AEM)

221.00

-0.49 (-0.22%)

NYSE · Last Trade: Mar 8th, 1:07 AM EST

March 6, 2026 — Global financial markets are reeling as gold futures successfully breached the unprecedented $5,300 per troy ounce milestone this week, cementing the precious metal's status as the ultimate hedge in an era of systemic instability. The rally, which saw spot prices peak as high as $5,594

Via MarketMinute · March 6, 2026

Boyd Group Services operates a broad network of collision repair and auto glass centers serving insurance providers across North America.

Via The Motley Fool · March 6, 2026

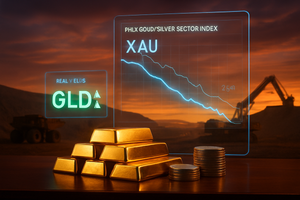

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

As the first quarter of 2026 unfolds, the gold mining sector has transformed from a traditional defensive harbor into a high-octane engine for portfolio growth. With spot gold prices surging toward the $6,300 per ounce mark, the industry’s heavyweights are witnessing a fundamental re-rating. Recent research notes from

Via MarketMinute · March 5, 2026

The global financial landscape has been thrown into a state of high-intensity volatility following the commencement of a massive, coordinated military campaign by the United States and Israel against Iranian strategic targets. As of today, March 5, 2026, the geopolitical landscape has shifted fundamentally, sending shockwaves through commodity pits and

Via MarketMinute · March 5, 2026

March 4, 2026 — The global financial landscape has been fundamentally altered this week as precious metals prices hit levels once considered the realm of speculative fiction. Gold has stabilized at a staggering $5,133.40 per ounce, while silver prices recorded a violent 11% surge in just five trading days,

Via MarketMinute · March 4, 2026

Gold prices surged by more than 1% today, March 4, 2026, as a dramatic escalation in Middle Eastern hostilities triggered a massive "flight to safety" across global financial markets. The precious metal, long considered the ultimate hedge against geopolitical instability, saw April gold futures climb to an unprecedented $5,178.

Via MarketMinute · March 4, 2026

March 3, 2026 — The global financial landscape has been fundamentally reordered this week as gold prices surged past the historic $5,100 per ounce threshold, eventually gapping as high as $5,419 in early March trading. This unprecedented rally is the direct result of a "perfect storm" of systemic shocks:

Via MarketMinute · March 3, 2026

LONDON — In a historic trading session that has sent shockwaves through global financial hubs, gold prices surged to an unprecedented all-time high of $5,270 per ounce on the morning of March 3, 2026. The parabolic move comes in the immediate wake of coordinated military strikes by the United States

Via MarketMinute · March 3, 2026

As of March 3, 2026, the global financial landscape has shifted decisively toward tangible assets, marking a historic turning point for precious metals. The SPDR Gold Shares (NYSEArca: GLD) has officially hit a monumental milestone, reaching $180 billion in Assets Under Management (AUM). This surge in capital follows a year

Via MarketMinute · March 3, 2026

As the global financial landscape navigates a tumultuous start to 2026, gold has emerged as the ultimate barometer of a world in transition. Despite a resilient U.S. dollar and a hawkish recalibration of Federal Reserve policy, the yellow metal continues to find bedrock support from a historic shift in

Via MarketMinute · March 3, 2026

As the global economy grapples with the fallout of sustained geopolitical volatility and a structural shift in currency reserves, the gold mining sector has emerged as the unlikely new champion of the equity markets. Newmont Corporation (NYSE: NEM) headlined this resurgence yesterday by reporting a staggering $7.3 billion in

Via MarketMinute · March 3, 2026

The global financial markets are in a state of high-octane volatility today, March 3, 2026, as precious metals reach prices that were once considered unthinkable. Gold has shattered all previous records, surging past $5,400 per ounce, while Silver has rocketed to $91 per ounce, marking one of the most

Via MarketMinute · March 3, 2026

CHICAGO — In a historic trading session that has sent shockwaves through global financial centers, gold prices surged to an all-time high of $5,361 per ounce on Monday, March 2, 2026. The 2.16% intraday jump comes as investors scramble for the ultimate safe-haven asset following a weekend of unprecedented

Via MarketMinute · March 2, 2026

On the morning of March 2, 2026, global financial markets awoke to a seismic shift in the valuation of "hard money." Spot gold prices surged to an unprecedented $4,380 per ounce, while gold futures on the COMEX breached the $5,400 mark, representing a historic decoupling from traditional price

Via MarketMinute · March 2, 2026

As of March 2, 2026, the global financial landscape is witnessing a historic decoupling of traditional economic correlations. Gold, the ancient hedge against uncertainty, has decisively shattered the $5,000 per ounce barrier, trading near $5,395 despite a Federal Reserve that refuses to budge from its restrictive 3.5%

Via MarketMinute · March 2, 2026

The global financial landscape underwent a seismic shift today as spot gold prices surged 2% to approach $5,400 per ounce, while silver climbed aggressively to $95 per ounce. The rally was ignited by a dramatic military escalation in West Asia, where coordinated U.S. and Israeli strikes on Iranian

Via MarketMinute · March 2, 2026

As of March 2, 2026, Newmont Corporation (NYSE: NEM) stands as the undisputed titan of the global gold mining industry. Coming off a historic 2025 that saw gold prices test the $5,000 per ounce mark, Newmont has successfully transitioned from a period of aggressive, multi-billion-dollar acquisitions to a phase of disciplined, high-margin execution. The company [...]

Via Finterra · March 2, 2026

This Toronto-based firm provides diversified gold and silver exposure through streaming and royalty agreements across 78 global assets.

Via The Motley Fool · February 27, 2026

The global financial order underwent a seismic reconfiguration on February 23, 2026, as the United States formalized a new 15% flat tariff on all imported raw materials and finished goods. This aggressive protectionist move, aimed at re-shoring industrial capacity, has triggered an unprecedented flight to "hard assets," accelerating a long-simmering

Via MarketMinute · February 27, 2026

The global financial landscape underwent a seismic shift during the week of February 23, 2026, as a "perfect storm" of geopolitical instability and deteriorating economic data forced a massive rebuilding of the risk premium in precious metals. Gold successfully established a firm foothold above the $5,150 per ounce mark,

Via MarketMinute · February 27, 2026

OR Royalties Inc. delivers exposure to gold through a royalty and streaming model, supporting diversified cash flow from mining assets.

Via The Motley Fool · February 26, 2026

Elemental Royalty operates a scalable royalty model, generating revenue from a global portfolio of precious and base-metal mining assets.

Via The Motley Fool · February 26, 2026

DENVER — Newmont Corporation (NYSE: NEM) has unveiled a robust 2026 capital allocation strategy, doubling down on shareholder returns despite entering a planned transitional year for its global mining operations. Following a fiscal 2025 that saw the gold mining giant generate a staggering $7.3 billion in free cash flow, management

Via MarketMinute · February 26, 2026

Via MarketBeat · February 26, 2026