Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Today you will see Gold price predictions based on technical analysis. What is the support and resistance on the daily time frame for XAUUSD?

Via Talk Markets · February 11, 2026

Both stocks reflect great options for those seeking AI exposure, though it’s undeniable that NVIDIA remains the leader of the pair...

Via Talk Markets · February 11, 2026

January CPI inflation slowed to 0.2% year-on-year as food prices fell sharply to -0.7% YoY due to Lunar New Year impacted base effects, and should flip in February. We expect CPI inflation is still on track to recover overall in 2026

Via Talk Markets · February 10, 2026

In this video, I break down the HOOD chart, show the key technical levels that matter now, and map out how traders can play the stock following this sharp earnings reaction.

Via Talk Markets · February 10, 2026

On 30 January, Chevron increased its dividend by 4.09%, from $1.71 to $1.78 per share. The dividend is payable on 10 March to shareholders of record on 17 February.

Via Talk Markets · February 10, 2026

As the SPY hits new record highs, institutional

Via Talk Markets · February 10, 2026

Bernanke’s policies have proved enormously damaging to the U.S. economy in three ways, and that damage is mostly still continuing.

Via Talk Markets · February 10, 2026

The past year has been wild and crazy for both gold and silver.

Via Talk Markets · February 10, 2026

Traders are navigating a rare Wednesday Non-Farm Payroll release, delayed due to the government shutdown. The market focus is on a

Via Talk Markets · February 10, 2026

In this video, Ira Epstein discusses the upcoming financial events and market conditions as of February 10, 2026. He highlights the anticipation of the non-farm payrolls data, expecting an addition of 55,000 jobs...

Via Talk Markets · February 10, 2026

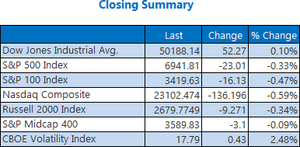

Stocks drifted lower today amid a $40 billion T-bill settlement and rising IV ahead of the Job report. Most of the action, though, came in the final hour or so of trading, with the S&P 500 dropping 33 bps and the Nasdaq 100 falling 56 bps.

Via Talk Markets · February 10, 2026

The USD/CAD pair trades in negative territory for the fourth consecutive day near 1.3550 during the early Asian session on Wednesday.

Via Talk Markets · February 10, 2026

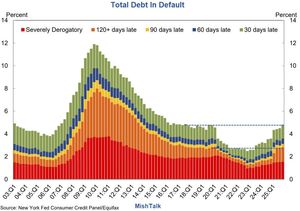

It will come as a surprise to exactly nobody that the Fed's latest quarterly Household Debt and Credit report reported total household debt balances increased by $191 billion in the 2025 Q4, a 1% rise from 2025 Q3, to a new all-time high.

Via Talk Markets · February 10, 2026

AUD/USD has paused on the high end of a rally peak.

Via Talk Markets · February 10, 2026

The US and most other countries are hurdling into a global sovereign debt crisis. One that is increasingly forcing them to

Via Talk Markets · February 10, 2026

The oil markets had a mixed day today.

Via Talk Markets · February 10, 2026

The market is witnessing a sharp rotation as investors shift from overextended tech

Via Talk Markets · February 10, 2026

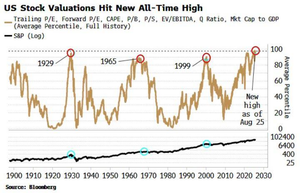

History Repeating? The Shiller PE Reaches a Level Seen Only Once Before

Via Talk Markets · February 10, 2026

XRP holds $1.30 support as analysts assess downside risk toward $1.07 and upside potential if resistance near $2.20 breaks.

Via Talk Markets · February 10, 2026

In healthy bull markets, tech leads. In healthy bull markets, the Nasdaq makes new highs before the Dow. We are seeing the opposite right now.

Via Talk Markets · February 10, 2026

Non-Farm Payrolls tomorrow.

Via Talk Markets · February 10, 2026

The S&P and Nasdaq have stalled rallies that haven't yet challenged resistance of their respective trading ranges.

Via Talk Markets · February 10, 2026

EUR/USD pulls back as hawkish Fed rhetoric offsets softer US economic data.

Via Talk Markets · February 10, 2026

Monthly dividend stocks offer more frequent payouts, but these 3 have unsustainable payouts.

Via Talk Markets · February 10, 2026

Via Talk Markets · February 10, 2026

Oil prices are up on geopolitical risks as well as strong US demand.

Via Talk Markets · February 10, 2026

SPY is now setting on the highs while the SPY/VIX is far below its high which is a negative divergence.

Via Talk Markets · February 10, 2026

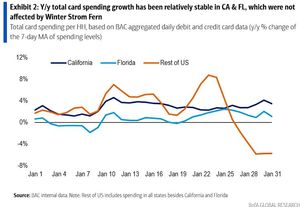

Credit card balances 90+days delinquent is the highest since 2011.

Via Talk Markets · February 10, 2026

Millicom International Cellular (TIGO) is up 148% over the past 52 weeks.

TIGO maintains a 100% “Buy” technical opinion from Barchart.

Via Talk Markets · February 10, 2026

Gold and silver prices aren't moving around that much, although the actual physical silver in the global inventories is moving plenty.

Via Talk Markets · February 10, 2026

Technical analysis on the stock chart for GLW.

Via Talk Markets · February 10, 2026

The dollar is steady near recent lows as the yen leads on post-election strength.

Via Talk Markets · February 10, 2026

The recent price action has been defined by consistent selling pressure, and the technicals remain the primary focus as I evaluate where the stock may stabilize if weakness persists.

Via Talk Markets · February 10, 2026

This isn't

Via Talk Markets · February 10, 2026

K-Bro Linen Inc. is a monthly dividend stock with a high yield. This potentially makes the stock more attractive for income investors looking for more frequent dividend payouts.

Via Talk Markets · February 10, 2026

The Dow secured a third-straight record close on Tuesday, while the S&P 500 and Nasdaq tumbled on the heels of lackluster retail sales data for December.

Via Talk Markets · February 10, 2026

Ethereum tests $2,000 support after sharp selloff as ETF inflows rise, with $2,400 recovery and breakdown risks in focus.

Via Talk Markets · February 10, 2026

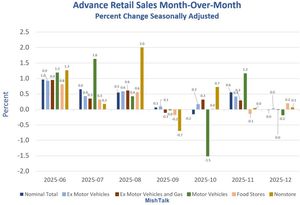

Economists missed the retail sales estimate for December by a mile.

Via Talk Markets · February 10, 2026

Shopify stock price has suffered a sharp reversal this year, moving from a high of $182 in October last year to the current $118.

Via Talk Markets · February 10, 2026

Gold slips despite weak US Retail Sales and softer labor costs signaling slowing economic momentum.

Via Talk Markets · February 10, 2026

Nasdaq, Inc. reported strong free cash flow and FCF margins for Q4, but NDAQ stock has dropped 14% since then. One attractive play today is shorting out-of-the-money put options with a one-month expiry.

Via Talk Markets · February 10, 2026

Rice was a little lower in consolidation trading and trends are still up. Futures have been recovering for the last month after a very long and sizable down move.

Via Talk Markets · February 10, 2026

Violent corrections do not end bull markets by themselves. In fact, in the later stages of powerful moves, they are often part of the process.

Via Talk Markets · February 10, 2026

The AI revolution is changing rapidly. And those investors who are properly positioned for it will catch the next wave of extraordinary gains.

Via Talk Markets · February 10, 2026

Warren Buffett and most of his value investing brethren subscribe to the philosophy of high concentration: “Put all your eggs in one basket and watch that basket closely”.

Via Talk Markets · February 10, 2026

On 15 January, BlackRock increased its dividend by 9.98%, from $5.21 to $5.73 per share. The dividend is payable on 24 March to shareholders of record on 6 March.

Via Talk Markets · February 10, 2026

In 2025, gold demand hit a record 5,002 tonnes, crossing the 5,000-tonne milestone for the first time. While often viewed purely as a monetary asset, gold's industrial utility is a critical, if sometimes overlooked, pillar of its value.

Via Talk Markets · February 10, 2026

Bitcoin holds key $68K support as analysts eye a rebound toward $85K, with EMA200, triangle compression, and demand in focus.

Via Talk Markets · February 10, 2026

On Tuesday, the UK's FTSE 100 index declined, dragged down by a sharp drop in Standard Chartered's shares following the announcement of its CFO's departure.

Via Talk Markets · February 10, 2026

Correlating with their pleasant stock performances, both biotech firms are thought to have ended fiscal 2025 with high double-digit EPS growth.

Via Talk Markets · February 10, 2026

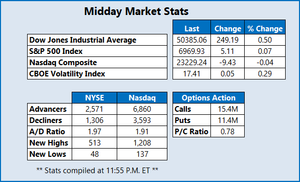

Stocks are mostly higher midday, as investors move back into software names and other valuable market areas.

Via Talk Markets · February 10, 2026

At €4.43 per share, Spotify topped Street estimates by an exciting “55%”, as social charges related to pesky Swedish payroll taxes that weighed on its stock last year, remained lower-than-expected in Q4.

Via Talk Markets · February 10, 2026

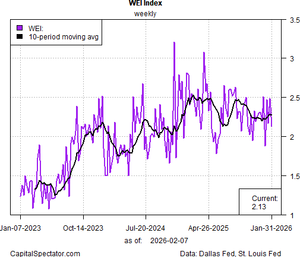

The labor market, by contrast, paints a weaker profile for economic activity.

Via Talk Markets · February 10, 2026

Cisco shares rose after the company unveiled its new Silicon One G300 AI networking chip, signaling a deeper push into AI data center infrastructure.

Via Talk Markets · February 10, 2026

Gold trades around $5,000 as markets await key U.S. data that could shift rate expectations.

Via Talk Markets · February 10, 2026

AUDNZD continues higher within wave (C) after breaking above the 2022 highs, though the rally is now entering a late-stage resistance area near 1.1750–1.1800.

Via Talk Markets · February 10, 2026

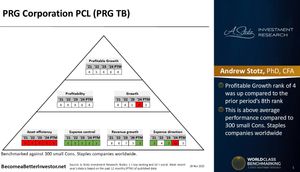

PRG Corporation Public Company Limited is a subsidiary of MBK PCL and one of Thailand’s largest rice manufacturers.

Via Talk Markets · February 10, 2026

The Canadian bank significantly upped its gold price forecast from $4,500 in October. CIBC analysts extended their bullish forecast into 2027, projecting an average price of $6,500 next year.

Via Talk Markets · February 10, 2026

Although the benchmark indices opened higher, they traded positively throughout the session and ultimately closed green.

Via Talk Markets · February 10, 2026

Ituran Location & Control has declared and paid quarterly dividends since April 2013 and paid annual dividends beginning in 2004. The January 2026 Q dividend of $0.50 suggests $2.00 annual dividend for the coming year.

Via Talk Markets · February 10, 2026

Nominally, retail sales were unchanged in December, after a downwardly revised +0.5% in November.

Via Talk Markets · February 10, 2026

Markets are anticipating just a 1-in-5 chance of easing at the next FOMC meeting.

Via Talk Markets · February 10, 2026

After November’s strong rebound, economists expected retail sales to rise 0.4% month-over-month in December, but the data disappointed, showing no growth and marking the weakest year-over-year increase since September 2024.

Via Talk Markets · February 10, 2026

The update says crypto markets are volatile and technically mixed, with some short-term rebound potential but bigger-picture risks still present, as traders watch key support and resistance levels.

Via Talk Markets · February 10, 2026

The Broadcom stock price has rebounded in the past few days, moving from a low of $295 last week to $345 today as investors cheer the recent plans for AI spending.

Via Talk Markets · February 10, 2026

The S&P 500 remains locked into the upper realms of its historic price.

Via Talk Markets · February 10, 2026

Via Talk Markets · February 10, 2026

Price action on gold has been quite calm in recent trade, as the metal decides whether or not to stay above the key $5,000 level.

Via Talk Markets · February 10, 2026

After yesterday’s sharp losses, the US dollar is mostly consolidating with a firmer bias against the G10 currencies.

Via Talk Markets · February 10, 2026

US stocks trading at all-time bubble-high valuations and making up a record weight of global stock holdings are sporting an even bigger bullseye for implosion.

Via Talk Markets · February 10, 2026

EUR/USD rose to 1.1911 on Tuesday. Pressure on the USD increased amid concerns that external demand for dollar-denominated assets could decline significantly.

Via Talk Markets · February 10, 2026

Authorities in China are advising Chinese banks they need to seriously consider changing up their bond market allocations right now.

Via Talk Markets · February 10, 2026

The cryptocurrency market has been ranging over the past two days, with many coins and tokens currently in the red.

Via Talk Markets · February 10, 2026

Tomorrow brings the first major data release of the week, with the belated jobs report providing the basis for a potential dovish shift in sentiment for the Fed.

Via Talk Markets · February 10, 2026