The past six months have been a windfall for The Honest Company’s shareholders. The company’s stock price has jumped 44.3%, hitting $5.34 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in The Honest Company, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re glad investors have benefited from the price increase, but we're swiping left on The Honest Company for now. Here are three reasons why you should be careful with HNST and a stock we'd rather own.

Why Is The Honest Company Not Exciting?

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

1. Long-Term Revenue Growth Disappoints

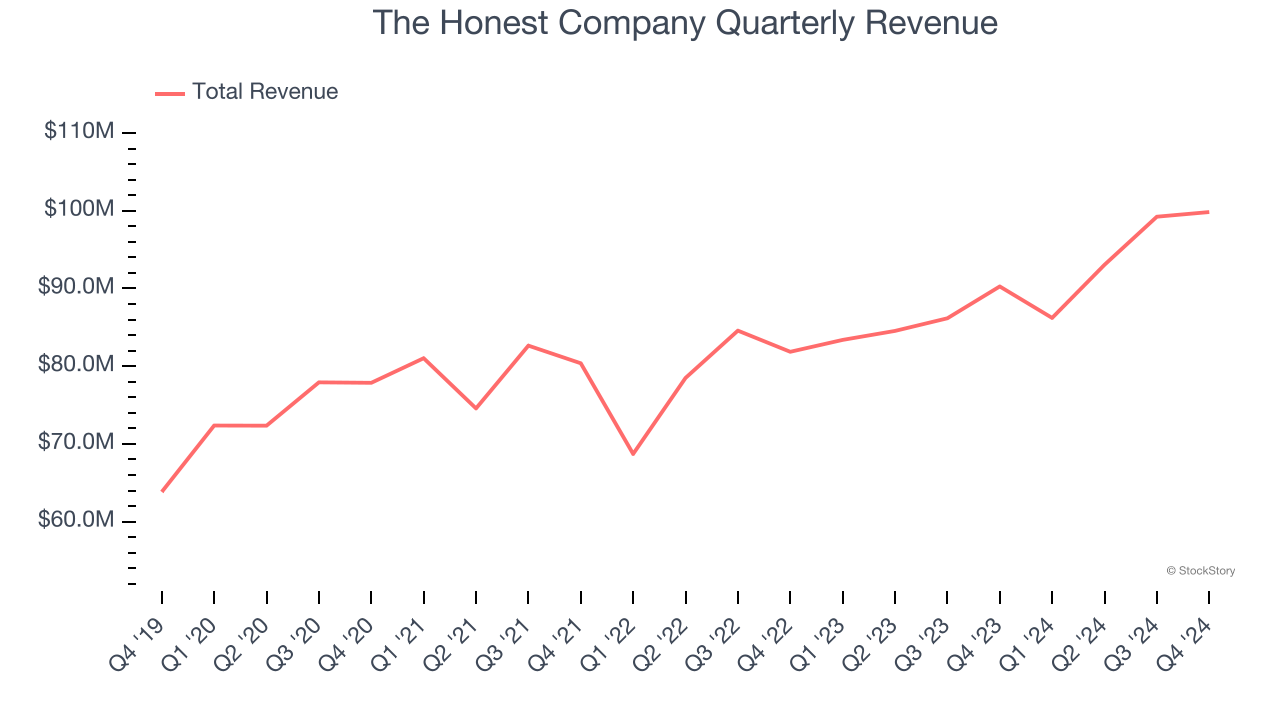

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, The Honest Company grew its sales at a mediocre 5.9% compounded annual growth rate. This was below our standard for the consumer staples sector.

2. Fewer Distribution Channels Limit its Ceiling

With $378.3 million in revenue over the past 12 months, The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Operating Losses Sound the Alarms

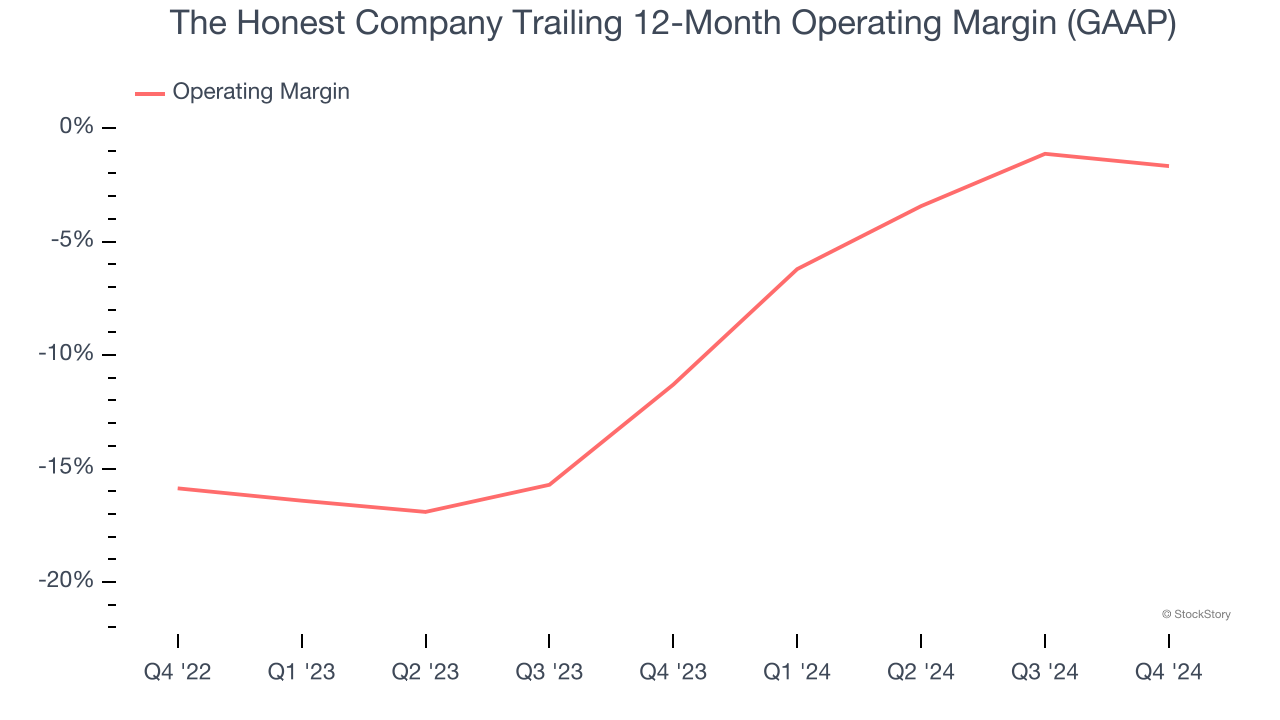

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, The Honest Company was one of them over the last two years as its high expenses contributed to an average operating margin of negative 6.3%.

Final Judgment

The Honest Company isn’t a terrible business, but it isn’t one of our picks. Following the recent surge, the stock trades at 21.3× forward EV-to-EBITDA (or $5.34 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of The Honest Company

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.