Kitchenware and home goods retailer Williams-Sonoma (NYSE:WSM) will be reporting earnings tomorrow morning. Here’s what to expect.

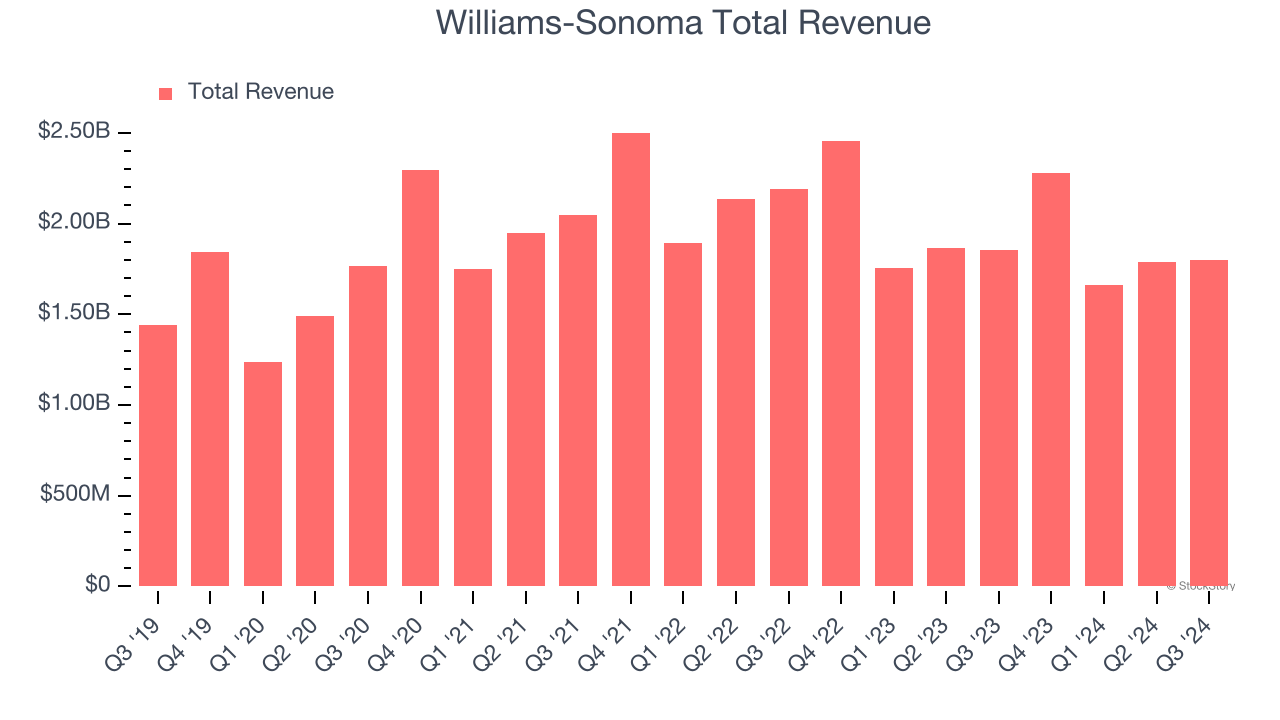

Williams-Sonoma beat analysts’ revenue expectations by 1.1% last quarter, reporting revenues of $1.80 billion, down 2.9% year on year. It was a strong quarter for the company, with a decent beat of analysts’ gross margin and EPS estimates.

Is Williams-Sonoma a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Williams-Sonoma’s revenue to grow 3.3% year on year to $2.35 billion, a reversal from the 7.1% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $2.94 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Williams-Sonoma has missed Wall Street’s revenue estimates three times over the last two years.

Looking at Williams-Sonoma’s peers in the home furnishing and improvement retail segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Arhaus posted flat year-on-year revenue, meeting analysts’ expectations, and Sleep Number reported a revenue decline of 12.3%, falling short of estimates by 3.3%. Arhaus traded down 21.5% following the results while Sleep Number was also down 42%.

Read our full analysis of Arhaus’s results here and Sleep Number’s results here.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. We prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.