Houston, Texas-based APA Corporation (APA) is an independent upstream oil and gas company focused on the exploration, development, and production of hydrocarbons. With a market cap of $9.1 billion, APA’s operations span the United States, Egypt, and the North Sea.

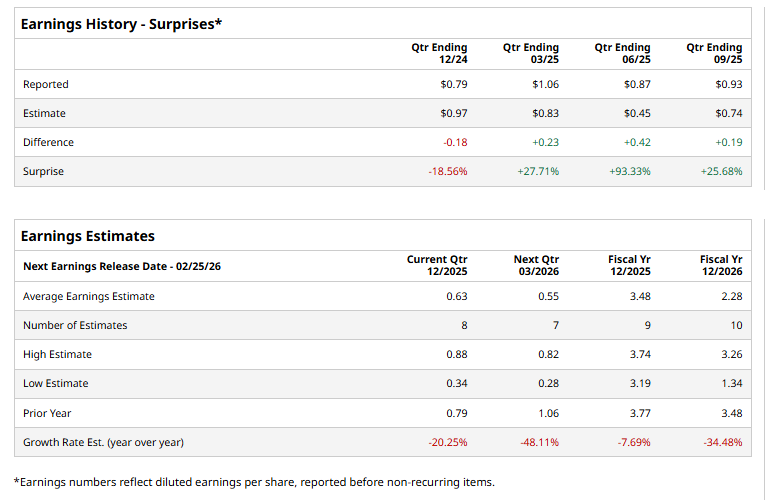

The energy major is gearing up to announce its fourth-quarter results at 10 am on Thursday, Feb. 26. Ahead of the event, analysts expect APA to report an adjusted EPS of $0.63, down 20.3% from $0.79 reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates in three of the past four quarters, it has missed once.

For FY2025, APA is expected to deliver earnings of $3.48 per share, falling 7.7% from $3.77 per share reported in fiscal 2024. In fiscal 2026, its earnings are expected to dip 34.5% year over year to $2.28 per share.

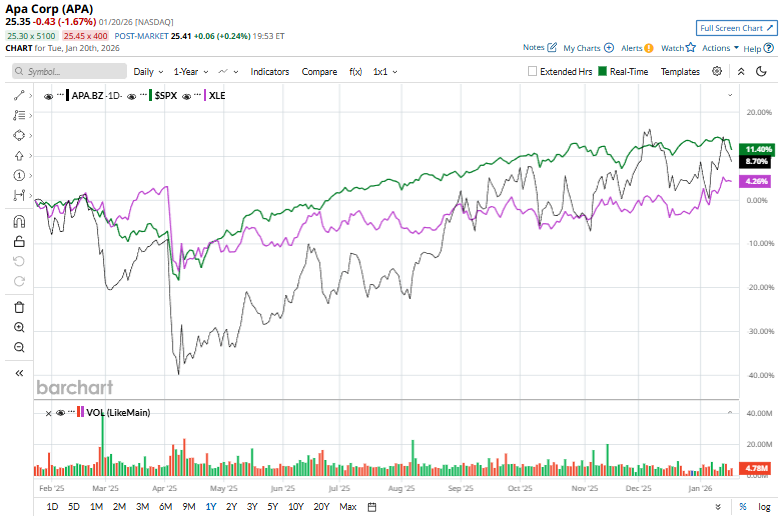

APA stock prices have surged 3.9% over the past 52 weeks, outperforming the Energy Select Sector SPDR Fund’s (XLE) 1.3% rise but trailing the S&P 500 Index’s ($SPX) 13.3% returns during the same time frame.

APA Corporation shares declined more than 2% on Jan. 15, as the energy sector broadly sold off following a sharp drop of over 4% in WTI crude oil prices, weighing on both energy producers and service providers across the market.

Analysts remain cautious about APA’s longer-term prospects. The stock maintains a consensus “Hold” rating overall. Of the 30 analysts covering the stock, opinions include five “Strong Buys,” two “Moderate Buys,” 19 “Holds,” one “Moderate Sell,” and three “Strong Sells.” The mean price target of $26.04 implies an upswing potential of 2.7% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart