Global markets are reacting to this past weekend's headlines of the US president going to war economically on European allies over Greenland.

Silver and Gold rocketed to new all-time highs while European stock markets were lower across the board, all as expected given the latest headlines.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Natural gas jumped to start the week on the latest US weather forecasts bringing winter conditions as far south as northern Texas, with another breakdown in that state's energy infrastructure expected.

Morning Summary: Yes, a number of market sectors are closed Monday, but there are some that are up and running – literally. Martin Luther King, Jr. Day is a US holiday only, with markets around the rest of the world buzzing along as usual. And, or course, the US president gave them something to buzz about over the weekend. In his inexplicable quest to own Greenland, the US president levied new tariffs against much of Europe, all of them allies of the United States, for their standing with Denmark and Greenland in defense against US actions. We can see how global markets reacted to the latest round of weekend chaos as silver and gold rocketed to new all-time highs while European stock indexes were under pressure to start the week. US stock markets are closed Monday, but stock index futures are trading with the three major markets in the red pre-dawn. The US dollar index was also weaker, down as much as 0.33 overnight.

Metals: Even though the Grains sector (as well as Livestock) are closed Monday, I still checked on markets Sunday evening given weekend headlines. What I saw was not a surprise. March Silver (SIH26) added as much as $5.82 (6.6%), hitting a new high of $94.365 and was still up $4.64 (5.2%) at this writing. The Cash Silver Index jumped to $94.08 as the world continues to deal with tight supplies and strong demand. How do we connect the dots between global chaos and silver, a market considered the lead industrial metal at this time? The more disregard the United States shows toward legal alliances (backroom alliances are a different subject) and international law in general increases the likelihood other major players can and will do (are doing?) the same. Russia’s latest illegal invasion of Ukraine is approaching its 4-year anniversary and China continues to covet Taiwan, the latter the root of the meteoric rally in silver. As for the historic safe-haven market Gold, central banks continue to buy due to the vacuum created by the loss of the United States as the leader of the western world. The Cash Index (GCY00) hit a high of $4,690 overnight, a gain of $93.62 (2.0%) while the February futures contract posted a high of $4,698, up $102.60 (2.2%) to start the week.

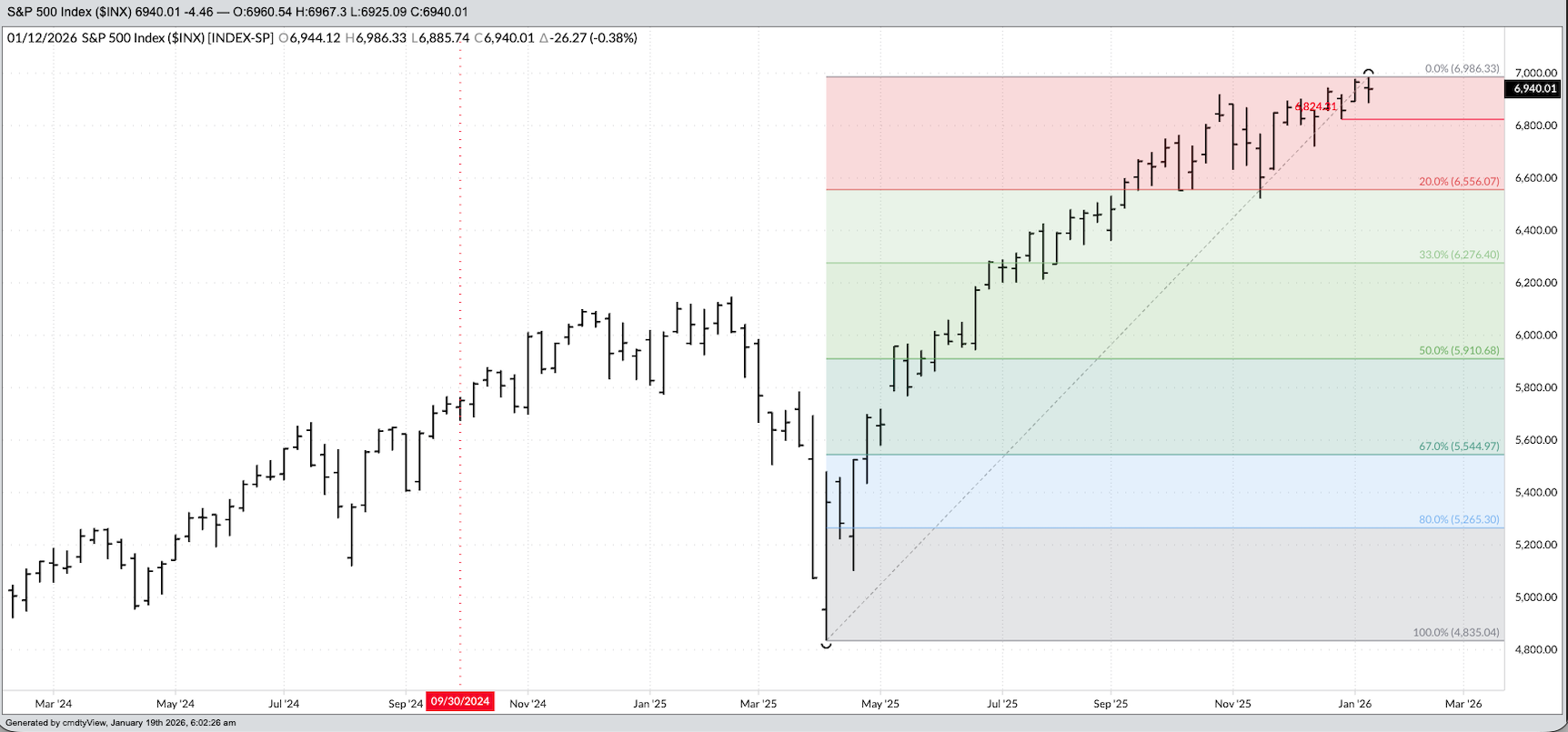

Equities: Global equity markets were under pressure Monday, once again raising the Chicken and the Egg Debate. Are Asian and European markets following US markets which were under pressure late last week, or leading US markets on the idea headlines are always being created and algorithms never sleep. Based on the idea US markets come first, a look back at last week’s action and we see the S&P 500 Index ($INX) completed a bearish key reversal on its weekly chart[i]. From a technical point of view, for what that’s worth, this told us the Index’s intermediate-term trend turned down. Theoretically, initial support would be the previous 4-week low of 6,824.31. If that gives way, then the downside target becomes the 20% retracement level near 6,556.00. As of this writing, the March S&P 500 futures contract is down 79.00 (1.1%) at 6,897.75 with the March Nasdaq contract off 402 (1.6%). For the record, the Nasdaq Index ($NASX) also looks to be in an intermediate-term downtrend. Globally, Asian markets closed mostly lower Monday with China’s Shanghai Composite the outlier, showing a gain of 12.09 (0.3%). As expected given weekend developments, European markets are lower across the board, the strongest being the UK’s FTSE 100 with a loss of 47.0 (0.5%).

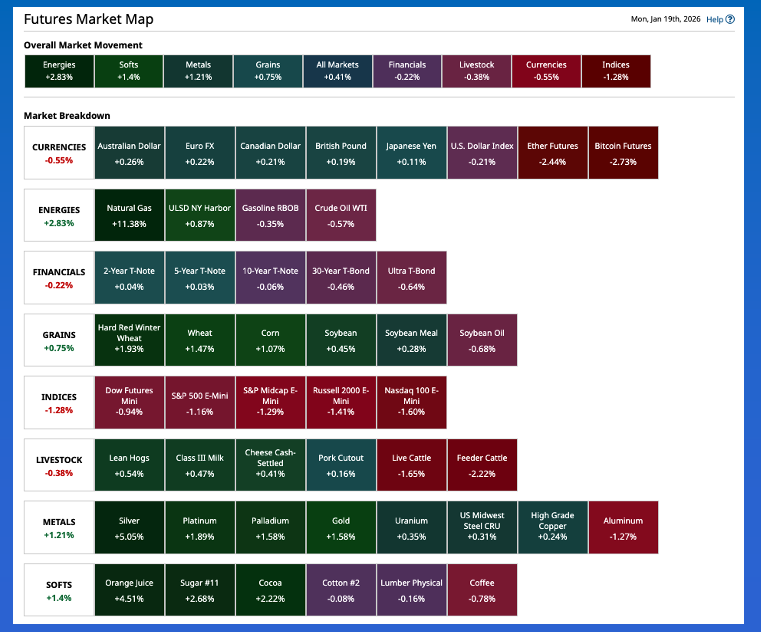

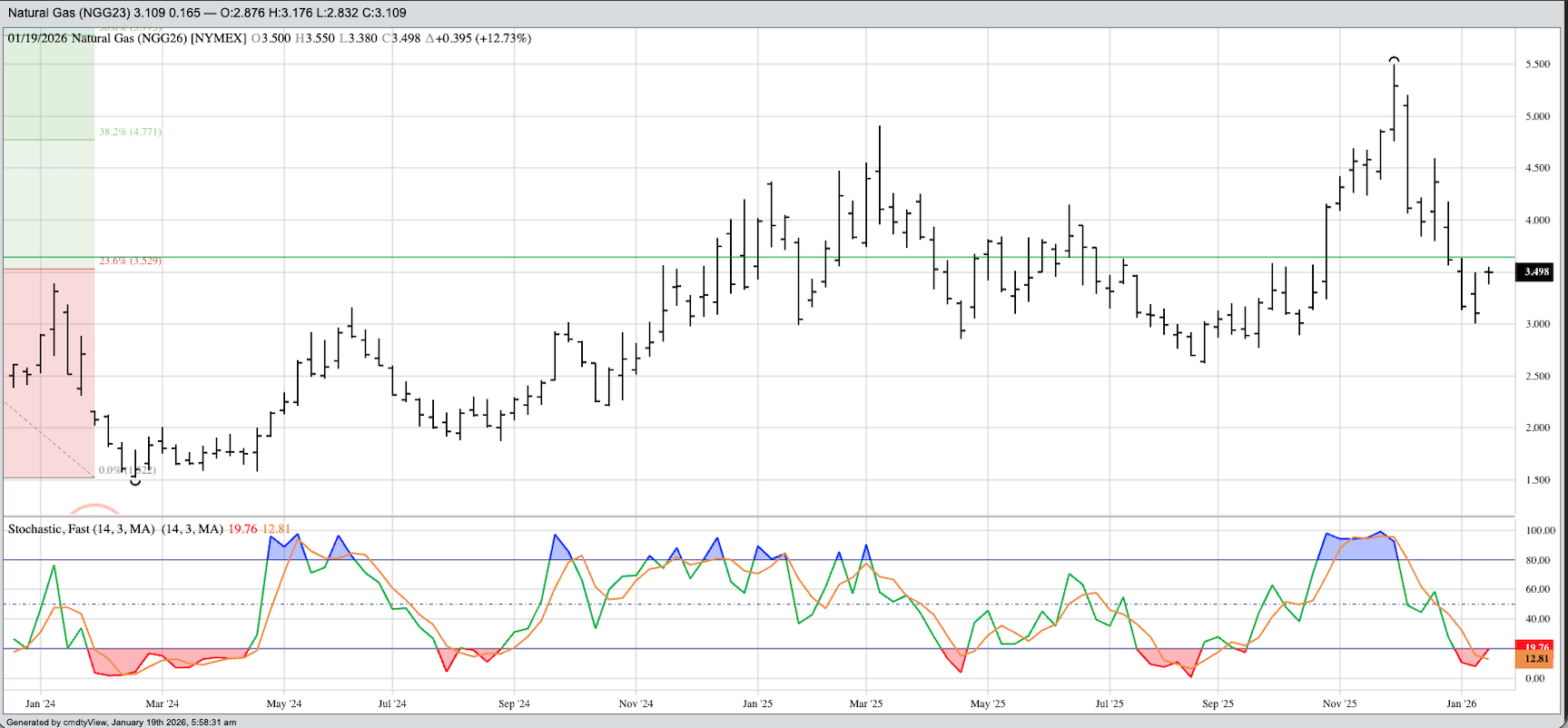

Energies: A look at Monday morning’s Barchart Futures Market Heat Map shows the Energies sector leading the way higher in the commodity complex with a gain of 2.8%. This is a bit misleading given WTI crude oil dropped as much as $0.74 (1.2%) overnight while RBOB gasoline slipped as much as 1.8 cents (1.0%). Both markets were still in the red at this writing. The spot-month distillates (heating oil, diesel fuel, jet fuel, etc.) contract rallied as much as 3.1 cents (1.4%). Things don’t quite add up, right? Let me add this, our old friend natural gas (NGG26), aka the Widow Maker, added as much as 44.7 cents (14.4%) and was still sitting 39.9 cents (12.9%) higher at this writing. What sparked this kind of move? The latest US weather forecast shows a winter storm – ice, snow, sub-freezing temperatures – falling as far south as northern Texas through late January, and we know what happens to Texas with this sort of weather occurs. What passes for the state’s energy infrastructure falls apart. Based on action in futures spreads, much of the buying interest seems to be coming from the commercial side, not surprising as end-users load up on supplies to provide heat over the coming weeks.

[i] Bringing to mind the Goldilocks Principle: Daily charts are too hot, monthly charts are too cold, but weekly charts are just right.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart